XDI acknowledges that we are on Aboriginal land and pay our respects to Elders past, present and future. We extend that respect to all Aboriginal and Torres Strait Islander peoples.

XDI Benchmark Series - Insights

XDI 1000 reveals widespread corporate exposure to financial impacts of physical climate risk

The first release of the XDI Benchmark Series underlines the increasing material risk of climate change to major listed companies and global indices, indicating that the financial impacts of climate change caused by projected worsening of extreme weather may be currently under-estimated and under-reported.

Introduction

XDI conducted asset-by-asset analysis of 2.1 million properties owned or leased by more than 1,300 companies listed on eight major indices. Analysis suggests that financial impacts will increase multi-fold for these businesses and indices under business-as-usual climate change projections.

The results presented below are based on analysis outcomes for three financial metrics, which have been normalised based on the 1990 average to protect proprietary data. Results focus on an index-by-index comparison, providing further insights into the global economic implications. The XDI 1000 benchmark provides a ranking of the listed companies according to the analysis.

Widespread climate physical risk exposure across eight major global indices

Indicators for physical climate risk worsen for all indices, however their positions relative to one another change over time. Risk is indicated by the cost of damage to physical assets using Maximum-to-Date Value-at-Risk (MVAR), Productivity Loss (PL) and the percentage of High Risk Properties (HRP) present in the portfolio.

Physical risk to eight global indices shown over time

Physical risk to eight global indices shown from 1990 to 2100

A closer examination of 2020-2050

Physical risk to eight global indices shown from 1990 to 2100

A closer examination of 2020-2050

The physical risk of eight global indices is plotted with Productivity Loss vs. Maximum Value-at-Risk. Click the play button or use the sliding scale to see the indices move through time, in 5 year increments. The size of the points will grow according to the normalised fraction of High Risk Properties.

* XDI commercial data is not disclosed. Relative values and positions are normalised using a scaling factor.

Observations

1990 to 2100

- Currently, The ASX 200, the Hang Seng and the Straits Times Index present the greatest risk of damage due to extreme weather events and resulting higher insurance costs , whilst the Nikkei 225 holds most risk from extreme weather impacts to physical assets, derived from MVAR.

- By 2100, all the indices but the DAX overtake the ASX 200 in terms of Productivity Loss and the Nikkei 225 accumulates the greatest risk across all three metrics.

2020 – 2050

- The tail on each index plots change over time from 2020 – 2050

- A closer examination of the time period between 2020 and 2050 shows a steep increase in all metrics within all indices.

- The normalised fraction of High Risk Properties, indicated by the increasing size of dots, suggests the most impact to owned and leased assets is in the Hang Seng in 2050, which also leads the pack in Productivity Loss.

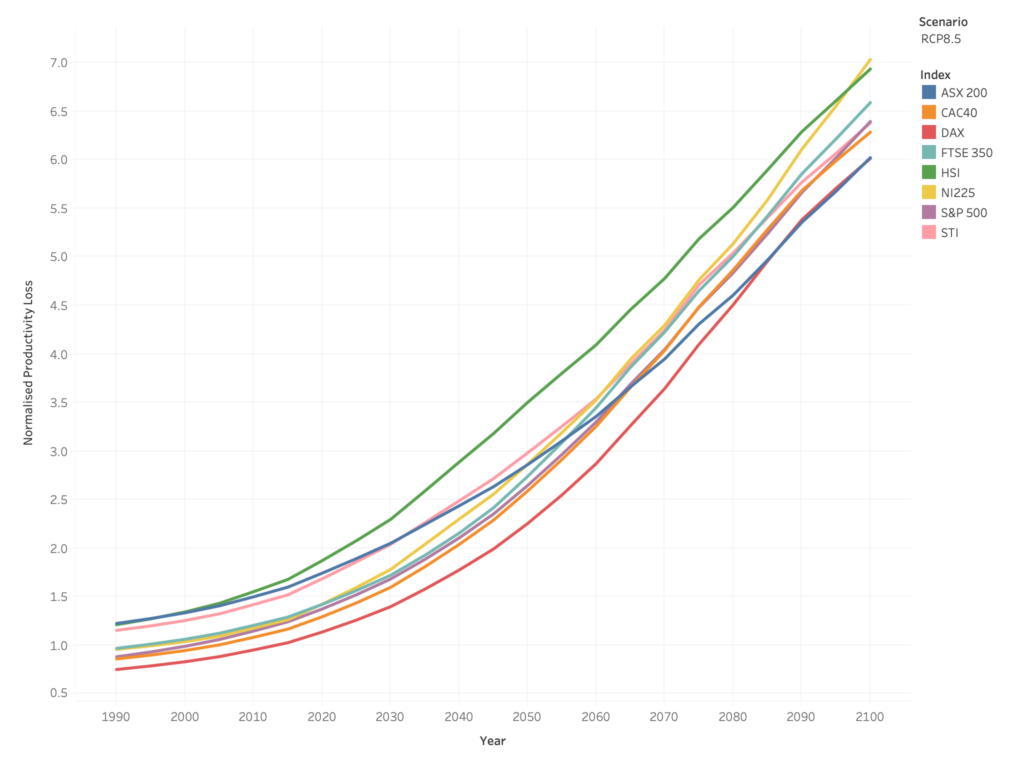

Climate-driven Productivity Losses will amplify

Productivity Loss is an important metric because it considers asset outage from both physically damaging and non-physically damaging events. Some events may cause damage, but others – like severe heat waves – can cause short term disruption without damage, if a factory becomes unsafe to operate for example.

Inferred impacts on aggregated revenues using the Productivity Loss metric suggest a 6 fold increase over time across all indices. Measured against the 1990 baseline, there is an 80% increase by 2030 in Productivity Loss, and a 185% increase by 2050.

Based on the Productivity Loss metric, the Hang Seng and the Australian ASX are currently the most likely to have revenue impacts from extreme weather and climate change. Over time, the physical risk indicators diverge considerably with the Hang Seng Productivity Loss increasing 25% more than the ASX 200.

Extreme events like storms and flooding contribute most to current Productivity Loss. Most companies have yet to experience many of the disruptions due to heat and coastal inundation, which results show as becoming material around 2030 (heat) and dominating losses later in the century (coastal inundation).

At the company level, results show some companies with Productivity Losses approaching 3% already, and these effects will be higher still at the asset level. For a company with a 20% profit margin, 3% loss of general revenue could translate to a 15% reduction in profits without considering elevated insurance costs.

Productivity Loss over time

Physical risk to XDI 1000 sample of companies shown over time

The XDI 1000 analyses more than 1,300 companies across eight global indices. The physical risk of these companies is plotted with Productivity Loss vs. Maximum-to-Date Value-at-Risk. The individual companies are coloured to show which index they are a part of and a specific index can be included or removed by clicking on the legend. Click the play button or use the sliding scale to see the indices move through time, in 5 year increments.

* XDI commercial data is not disclosed. Relative values and positions are normalised using a scaling factor.

Scale of risk and relative exposure

Of the 2.1 million individual assets analysed across all companies, 88,000 assets are at High Risk in 2020. If these assets are retained, the number of High Risk Properties increases to 168,000 under the highest emission scenario by 2100.

Currently, companies in the ASX 200 index are modelled to be the worst performing — six of the ten worst performing companies for Productivity Loss in 2020 are on that index – followed by the FTSE 350.

Over time, companies in the Nikkei 225 index are more exposed to future projections of sea level rise and escalating temperatures. This index becomes the worst performing in the latter half of the century.

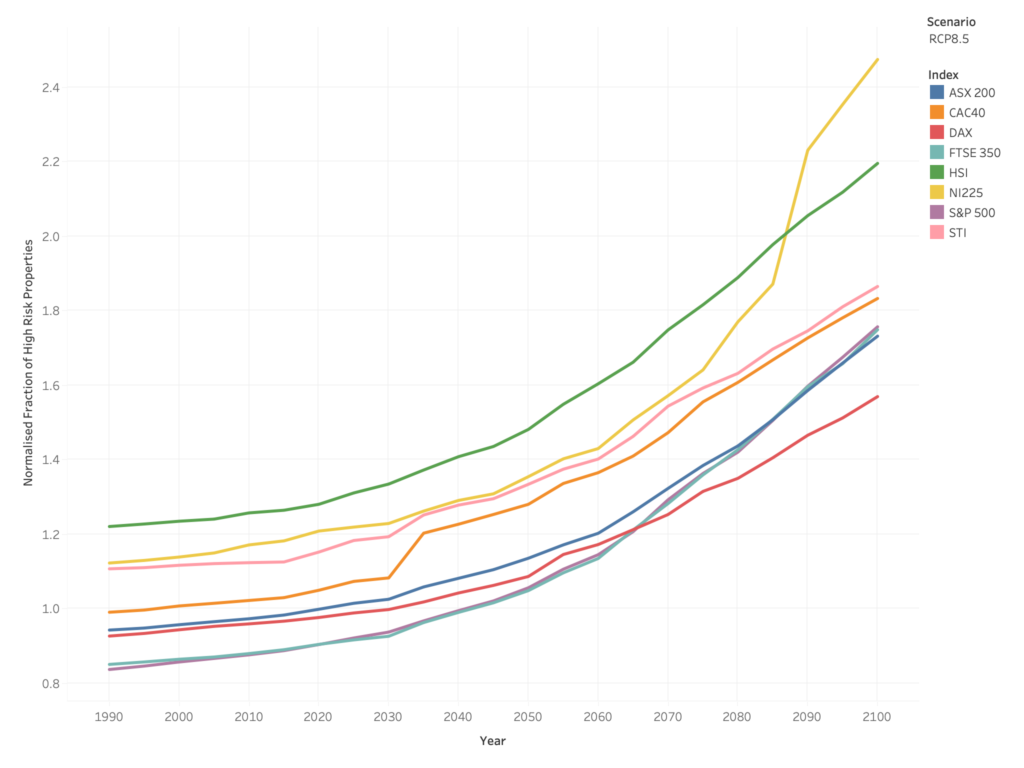

Doubling of High Risk Properties has implications for financial stability

Perhaps the most serious insight for investors is the doubling of the number of High Risk Properties the analysis identifies between 2020 and 2100. High Risk Properties are classified as having MVAR over 1% , derived by calculating return frequencies and severities on the assets location to estimate asset damage risk.

Such assets present a risk to a company’s operational continuity, and a roll-on risk to stability of national and international economies. A further risk is implicit in the data for the owners of leased assets, with potential loss of tenancy, asset damage, and increased insurance premiums.

XDI Metrics

These results are derived from asset level analysis considering annual average losses from asset damage, loss of productive time in operational assets and employees, and the location of operational assets in areas of high exposure to climate exacerbated extreme weather. For more detailed information on XDI metrics click below.

The analysis shows that there will be steady increases in the number and proportion of operational assets owned or operated by companies in each index that become unavailable due to extreme weather. Many assets will not have a significant drop in Productivity Loss, but the results suggest some will be effectively inoperable due to climate change – for example, those subject to repeated coastal inundation events.

High Risk Properties over time

Observations

- The proportion of High Risk Properties expressed as a fraction of total owned and leased assets, on average doubles across all companies in all eight indices sampled from 1990 to 2100.

- The increase in High Risk Properties ranges from a 68% increase for the companies in the Straits Times Index to an 120% increase for the Nikkei 225.

- While the FTSE 350 starts lower, it has a markedly higher rate of increase that all of the other indices apart from the Nikkei 225.

- The steep increase at the end of the century for companies in the Nikkei 225 is due to flooding and coastal inundation.

The need for sophisticated data and consistent reporting

XDI’s Benchmark Series contributes to global efforts to standardise the classification, measurement and disclosure of climate risks, promoting the efficient allocation of capital for climate adaptation.

These findings underline the need for increased investment by companies in assessing and disclosing climate-related physical risk and advancing their management and adaptation strategies based on best available data.

Regulators and investors should exercise caution in relying on self-disclosed TCFD reporting of climate physical risk and can now avail themselves of comparative third party data.

Regulators requiring disclosure of physical climate risks should also enable reporting of adaptation strategies.

A globally-consistent approach climate physical risk reporting methods, metrics and responses – such as those provided in XDI 1000 – are the only way for regulators, investors and companies to ensure comparability and consistency.

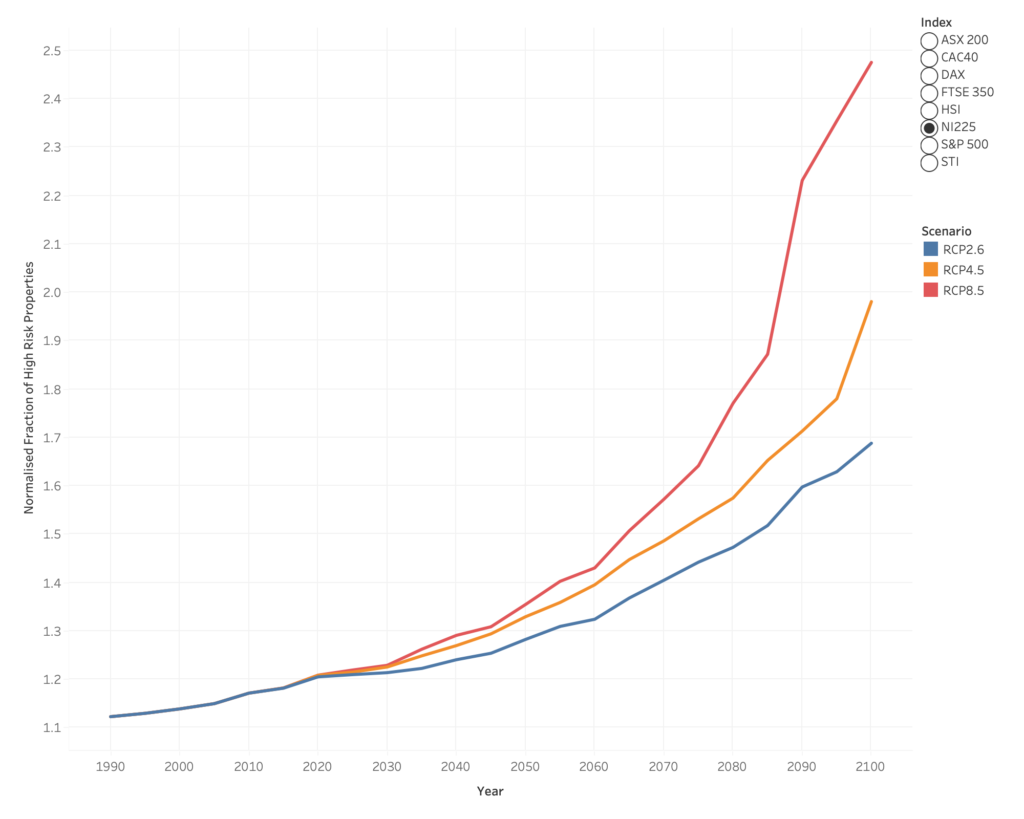

Lowering Emissions Lowers Risks

The XDI 1000 data set has been run on RCP 8.5 for purposes of stress testing the physical assets at the most extreme range of climate hazard impacts. The analysis can also be run with lower emissions scenarios to consider the relative impacts of climate change mitigation.

Comparing emissions scenarios for a single index over time shows the relative pathways and potential minimisation of risk if emissions mitigation occurs. This can be done according to any chosen metric. Results for the Nikkei 225 according to HRP% suggest that as much as 4% (7,500 properties) could be avoided if RCP 2.6 is used vs RCP 8.5.

High Risk Properties under different emission scenarios

Observations

This graph shows the physical climate risk in terms of High Risk Properties over time for the companies from the Nikkei 225 comparing the results for three different emission scenarios.

- While different emissions scenarios will reduce financial impacts from around 2030 onwards, there is no substantial divergence before then as existing emissions in the atmosphere will have impacts that cannot now be reversed.

- Allowing greenhouse concentrations to continue increasing unchecked would more than double the increase in risk.

- Lower emission scenarios show that the increased losses to 2030 are now largely unavoidable, but thereafter, 26% of increases to the proportion of High Risk Properties (45,000 assets) may be avoided if emissions reductions are achieved.

Comparing four automotive manufacturers – a deeper dive

Company level risk differentiation can be seen by analysing four auto manufacturers in Europe, USA and Japan for extreme weather and climate risks. Analysis was run on a large Japanese car manufacturer in the Nikkei, a large German auto-group in the DAX, a US originated company on the S&P 500 and, by way of contrast, a niche car manufacturer on the FTSE.

XDI identified 9,500 assets in more than 80 countries directly associated with the selected companies. Subsidiary companies and brands were only partially included in this analysis. Examining different metrics provides crucially different insights into a company’s climate physical risk profile – from generalised revenue impairment to the risk of losing critical group assets to major hazards.

Physical risk to four automotive manufacturers shown over time

Observations

For the next two decades, the Japanese auto-manufacturer maintains the highest Maximum-to-Date Value-at-Risk (MVAR) and the US company is most exposed to Productivity Loss (PL). All companies see MVAR and PL increasing to the middle of the century. After the middle of the century, the maximum value-at-risk for the company listed in the UK rapidly escalates and reaches higher values than each of the other auto-manufacturers.

Productivity Loss over time

| Observations Productivity Loss best indicates revenue impairment, reflecting the lost productive availability of the asset for which the asset when it is assumed to be unfit to operate due to component failure, damage or repair.

|

High Risk Properties over time

High Risk Properties The proportion of High Risk Properties (HRP) is an indicator of assets beyond typical insurability thresholds, highlighting facilities that could be knocked out of availability due to serious hazards such as flooding, forest fire and cyclones or property assets that could affect other parts of an operational chain within a company such as a parts factory which if lost could affect the ability of other factories to continue production. | Observations

|

Company Level Insights and Multiple Company Data

Intelligence on your investments

The analysis underpinning XDI 1000 data set is based on our Company Intelligence analysis for investors. Investors with a portfolio of equities can now obtain intelligence on the climate resilience of any number of companies world wide for due diligence, investment decision making, or to compile risk ratings.