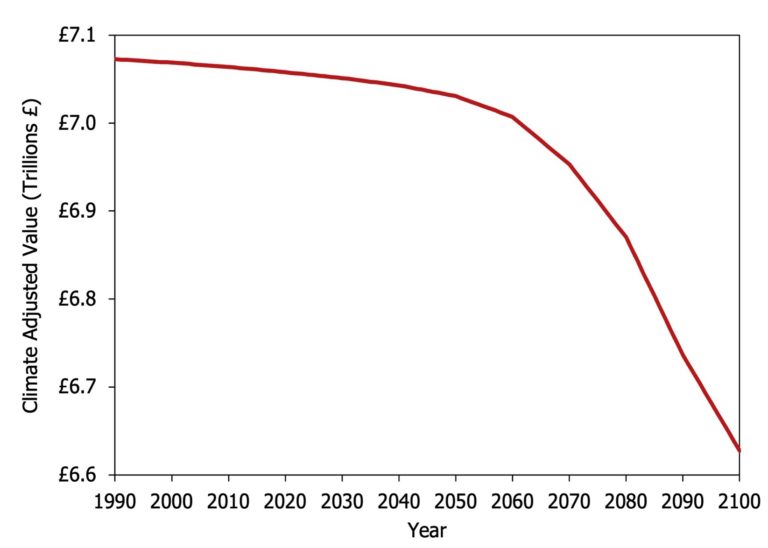

1.4% Property Value Corrections Overdue, 7.5% of climate correction projected

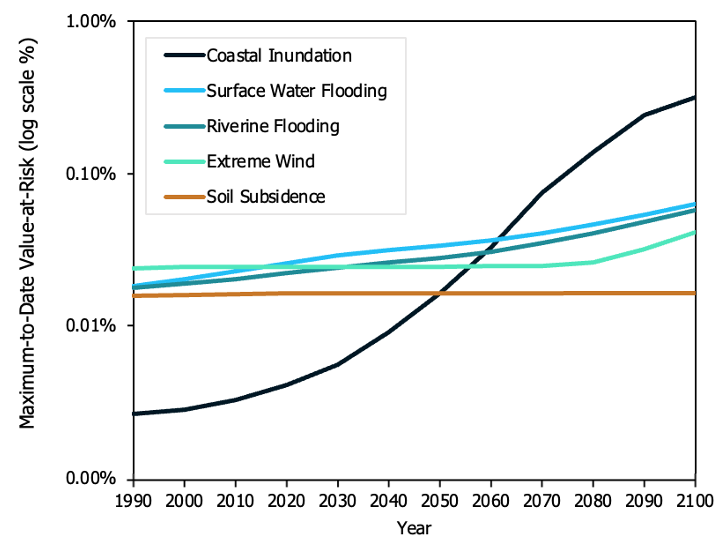

As both commercial and residential property buyers start to consider climate change and insurance costs in their purchasing decisions it is to be anticipated that properties highly exposed to extreme weather and climate change impacts will be decrease in value relative to the market. In some cases those declines may be severe enough to cause negative equity.

- The modelling suggests an overdue market correction of 1.4% due to climate impacts

- Looking forward, the decline will increase to 1.7% by 2050 and 7.5% by 2100.

- Value of the likely correction is over half a trillion pounds (~ £525bn) before 2100.