XDI acknowledges that we are on Aboriginal land and pay our respects to Elders past, present and future. We extend that respect to all Aboriginal and Torres Strait Islander peoples.

An open letter to Professor Andrew Pitman - Director of ARC Centre of Climate Extremes

October 22 Update: Professor Pitman has provided a reply to this letter here

October 6, 2021

Dear Professor Pitman,

I am compelled to respond to your comments on LinkedIn and in the media regarding the recent study released by the Reserve Bank of Australia (RBA), and regarding the Australian Prudential Regulation Authority’s (APRA) work to guide climate-related financial disclosure. Overall, your comments directly undermine work being done to identify communities at high risk from extreme weather and climate change. To propose that “if you live in one of the areas mentioned don’t stress” is, I believe, grossly irresponsible and highly misinformed. I would ask you to reconsider these comments.

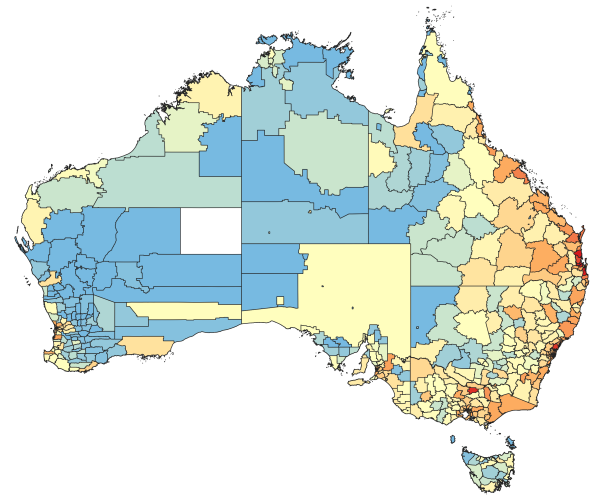

Last summer 34 Australians died in bushfires, thousands were left with damaged homes and many financially ruined by flooding because they were unable to afford insurance. The areas affected are in fact highly consistent with high-risk areas identified by XDI and Climate Valuation (and used by RBA). Evidently, we do have insightful data on location specific risk. More importantly, as professionals working in the field of climate change, I believe we have a moral obligation to use what we know to warn people, communities, business and governments about the risks they currently face – many of which may be worsening with climate change.

I find your comments surprising since your organisation has received $30m for research “to make Australia more resilient to climate extremes and minimise risks from climate extremes to the Australian environment, society and economy”. Our work is to the same end, as are APRA’s draft guidelines for climate risk reporting.

Your specific concerns about the extent to which downscaling can be meaningful are insightful and worthy of proper consideration, which I will address below. But I believe it is entirely misleading to use it as a pretext to dismiss a large body of engineering and hazard-based risk analysis. Our methods, data and software have been in continuous development for over 10 years and I am unconvinced you have the breadth of knowledge to critique the full extent of the work that physical risk analysis entails.

While atmospheric physicists like yourself may not be able to generate property-level insights, our cross-disciplinary team can and does. The team that produced the data on which the RBA based its analysis includes engineers, geologists, hydrologists, mathematicians, statisticians, climate scientists and financial analysts. The same team works with some of the world’s leading banks in Europe and Asia, as well as with governments and institutional investors, to build resilience in critical infrastructure and the global economy. This has been driven by the global movement toward climate risk reporting following the international Financial Stability Board’s Taskforce for Climate Related Financial Disclosure (TCFD) guidelines.

The TCFD initiative and the resulting wave of regulatory pressure (such as APRA’s draft guidelines) is one of the most significant moves of recent times to stem runaway climate change. It’s a powerful and positive catalyst for corporate climate action globally, and it’s gaining momentum. It is therefore critical that analysts use the best available information to influence decision making at the highest levels of industry and government. We applaud APRA’s and the Bank of England’s leadership, and the actions of the French, New Zealand and Canadian governments toward mandatory reporting. We look forward to being part of the robust reporting solutions that enable other governments to do the same.

Climate risk analysis needs more than climate science

In the interests of bridging the gap of understanding between your work and ours, I’d like to take a moment to dispel any incorrect understandings about property level acuity, because this issue is very important. It is at the level of individual homes and businesses that real people are at risk, and equally where we have the opportunity to help get these people out of harm’s way.

The fundamental flaw in your assertion that climate change modelling data cannot be used for asset or address level risk analysis is that climate data is at the centre of the analysis. If it were, I would agree that the spatial limits, uncertainty and ‘noise’ of limited data sets would be overwhelming. Instead, it is necessary to call on other data sets, other fields of knowledge and other mathematical techniques to build a solid foundation of present-day exposure and vulnerability to physical hazards. On this foundation our team then applies climate modelling to provide additional insights.

To undertake robust asset level physical risk analysis there must be an understanding of three factors: the vulnerabilities of the asset; the hazards to which it is exposed; and how those may change in the future due to climate change.

Vulnerability analysis is primarily an engineering skill set which considers the materials from which properties are constructed and the design specifications used to bring these together. Hazard analysis can draw on hydrology, geology and satellite mapping of the biosphere and requires the accumulation and management of large data sets. Hazard data is often highly localised and needs to be. For example, the technology exists to tell the difference between the side of a street that gets flooded when a river overflows and the side that does not.

By bringing existing vulnerability and hazard information together in our computational system (“Climate Risk Engines”) we are able to compute baseline levels of risk. The Risk Engines can test if a wall is made from concrete and therefore impervious to flooding or lined in plasterboard and ruined by water. We can test to see if a property is likely to get inundated by high seas or is sufficiently elevated to avoid inundation. We know that a property built in the 1970s will not withstand a cyclone like a property built-in 2010. In this way we can identify properties that are at risk from a range of extreme weather events.

Dealing with uncertainty

Then and only then do we consider if climate change impacts may worsen the current risks. As you know, Global Circulation Models operate at the 100s of kilometre scale, while Regional Climate Models can only achieve resolutions down to 10s of kilometres. You correctly point out that the reliability of downscaling has to be questioned and managed. Sometimes, a long-term trend can be identified, e.g.: an increase in heatwaves, more frequent severe rainfall events or a rise in fire weather conditions. This can be used to provide a forward outlook which includes climate change exacerbation. Sometimes no trend is clear, the variability is large, or perhaps hazards even appear to diminish. Often different models have different outcomes. All of these issues have to be managed and communicated. We see our job as understanding the ‘risk envelope’ from these models, so that decision-makers can plan for all possibilities.

In practice, that means that we start with a baseline position of risk which we assume provides a ‘risk floor’ for each hazard, then we look at the highest levels for driving parameters from the climate data as far as 2100, which provides ‘risk ceiling’. We communicate to decision-makers that this is the range of futures we can see so far.

We are aware of the limits of climate data and are contributing to research to understand uncertainties and increase efficacy. We are currently embarking on an internal project to use ‘spatialisation’ to increase the amount of climate data to inform trends for a given location. We have also sponsored a Ph.D. in statistics and data science at the University of Newcastle to investigate uncertainty in the processes of computing extreme weather and climate risk. But while we strive to constantly progress the state-of-the-art in physical risk modelling, we remain committed to using what we have available now to drive better decisions in the face of climate risk.

It takes many actors to change the world

While I understand the importance of your work in fundamental climate science, our work to get this science into a form people can use is equally important. This year our team has undertaken analysis on nearly 37 million assets around the world. Every month we provide hundreds of free reports to homeowners wanting to check their risks from flooding, high seas and forest fire. It was our team that undertook the climate heat-stress analysis referenced by Federal Court Justice Bromberg in this year’s landmark court case deciding that the Minister for the Environment has a duty of care toward Australia’s children. In many instances we have made this data available at no cost.

I have greatly appreciated your work and leadership on climate science in Australia. But as the world sprints toward dangerous climate change this is no time for turf warfare or taking aim at those institutions working with critical sectors of our economy to mitigate impacts to people’s safety and financial security. Instead, I firmly believe our community of scientists must use the time we have to work together, play to one another’s strengths, constructively fill gaps and weakness, and support those who can use our skills – from the CEO of the RBA, to a person living out their senior years in a caravan park.

I hope this note has dispelled some myths, better informed people who follow your comments about what companies like XDI and Climate Valuation do and why, and perhaps provided some pause for thought about the importance of how we all manage our differences. I look forward to ongoing discussions as we strive to do the best we can to solve the greatest challenge of our time.

Sincerely

Dr. Karl Mallon

CEO Climate Valuation

Director of Science and Technology, XDI Systems

October 22 Update: Read Professor Pitman’s response here

Related article – Top scientist says APRA climate risk guidance ‘flawed’.