XDI, powered by Climate Risk Engine

Global I Vast data sets I Asset-level analysis

Climate Risk Engines were created in 2011 to compute the cost of climate change risks so that the financial consequences of rising greenhouse emissions could be understood.

Developed by scientists, engineers and climate risk experts, this was the first time the cost of physical climate risk had been quantified in this way.

Today, Climate Risk Engines are one of the most flexible, powerful and trusted sources of physical climate risk data in the world.

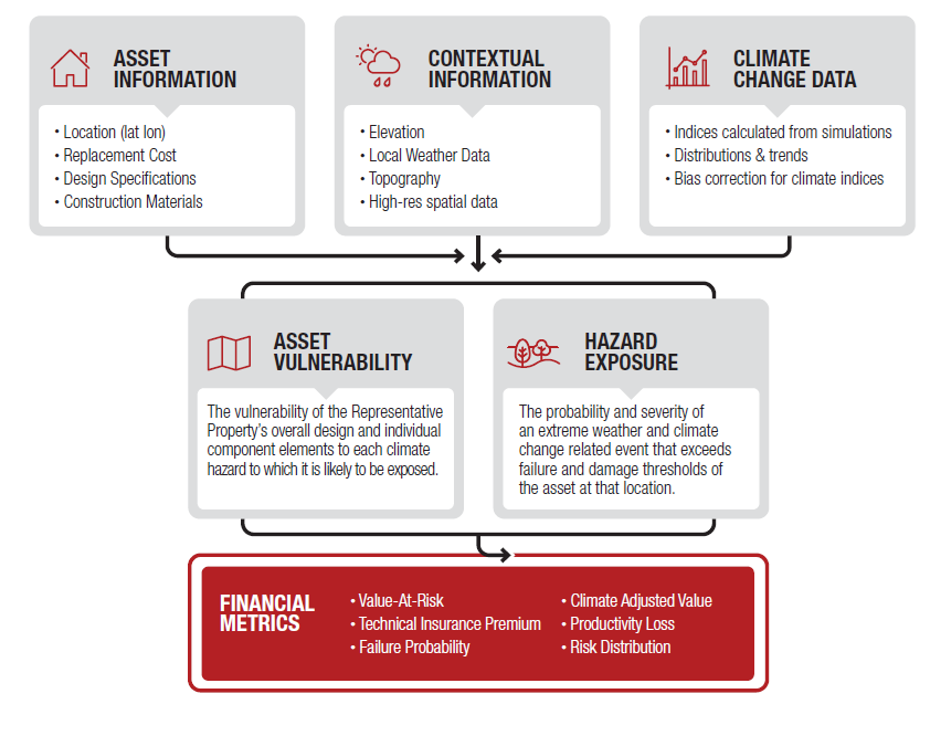

How Climate Risk Engines work

- Climate Risk Engines extract dynamically downscaled global and regional climate change models and combine these with global and local data sets, applying bespoke probabilistic algorithms to produce decision-ready financial and risk metrics.

- Climate Risk Engines use engineering-based methods to assess exposure and vulnerability of asset archetypes to understand the likely damage and failure probability of assets caused by extreme weather and climate change hazards.

- The coverage is global, granular, sophisticated and under constant improvement.

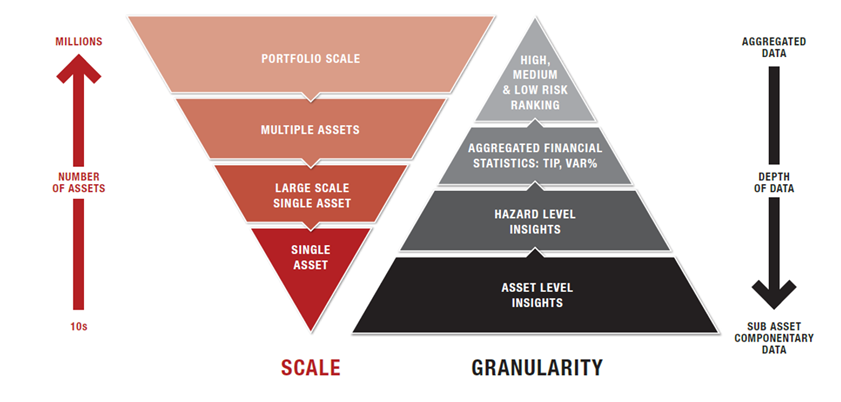

- Results are expressed in a range of engineering or financial metrics to inform decision-making at all scales.

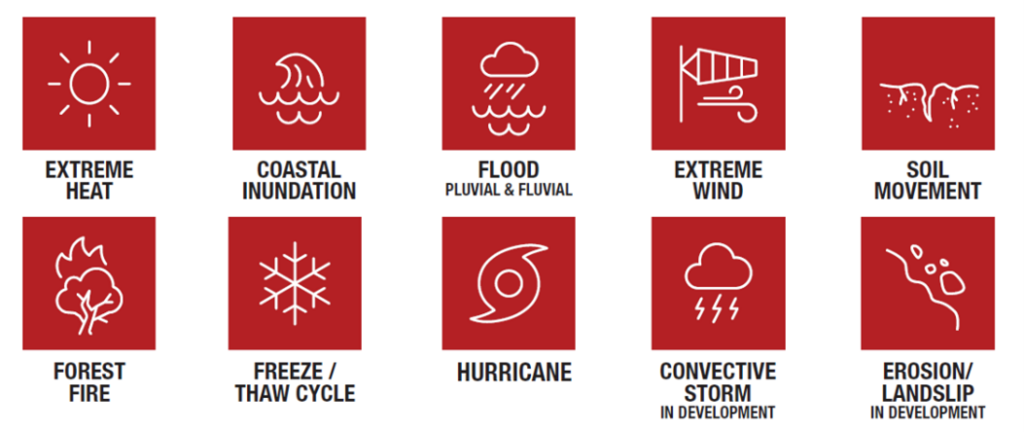

Hazards analyzed

Ten different climate change exacerbated hazards are evaluated to determine acute and chronic risk to property.

Sector specific asset types for granular analysis

Over 140 individual asset types provide in depth insights and information. New archetypes are created as needed.

Portfolio analysis for investors and lenders

Bespoke algorithms process massive data sets using localised weather data, applying climate models for future changes, and overlaying location and asset data for financial and physical impact outputs.

This system allows the application of asset-level analysis for an understanding of physical risk to portfolios of millions of operational assets around the world.

Cross Dependency Analytics

- Bespoke algorithms are used to find the critical infrastructure required to run each asset.

- Includes power, communications, water and access.

- Cumulative upstream risk is added to the risk profile of each asset being analyzed.

Climate Data

- Dynamically-downscaled Regional Climate Models (RCMs) from the CORDEX project, based on recent Global Climate Models (GCMs) simulations from CMIP5 and CMIP6.

- Emission models are used for asset stress testing under a higher emission, business-as-usual scenario – consistent with the current global emissions trajectory RCP8.5 and lower emission trajectories RCP6.0, 4.5 and 2.6.

- High resolution simulations, allowing fine-scaled local projection of climate hazards (from 50km down to 10km in some areas).

Location specific data

- International address matching.

- Global flood data at 30m resolution and 5m resolution in some areas.

- Global LIDAR elevation data at 30m horizontal resolution. 5m available in some areas.

- Global vegetation maps for fire at 30m resolution.

- Soil maps at 30m resolution for subsidence.

Secure international servers

- Climate Risk Engines now use an auto-scaling cluster architecture to enable parallel computing on demand.

- Provisioned by Infrastructure as Code, the service can be securely deployed anywhere around the world – asset data need never leave the host country.

- Azure/GCE/EC2: Climate Risk Engines can run on most major cloud providers: Microsoft Azure, Google Cloud Platform, Amazon Web Services, and more.